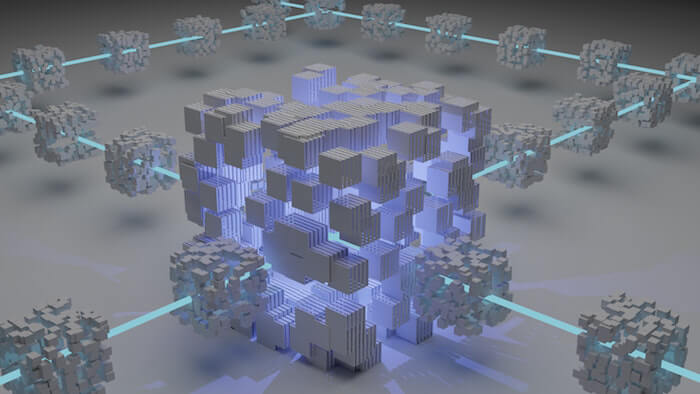

Decentralized Autonomous Organizations

DAOs are decentralized autonomous organizations that operate through a set of rules written into the blockchainThe idea is that these rules will be transparent, immutable and, above all, democratic.

Decentralized autonomous organizations, or DAOs, are organizations governed by computer programs and the community of users who interact with them. The governance rules are transparent and immutable because they are written into the blockchain. These rules provide the framework for how decisions are made within a DAO.

DAO governance is coordinated using tokens or non-fungible tokens (NFTs) that grant voting power. Admission to a DAO is limited to those who have confirmed ownership of these governance tokens in a wallet. crypto-currency, and membership can be traded. Governance is achieved through a series of proposals that members vote on via the blockchain, and holding more governance tokens often translates into greater voting power.

Security

Decentralized autonomous organizations (DAOs) are one of the most exciting blockchain projects. They are essentially a collection of smart contracts that can coordinate to perform functions such as fundraising, payroll, and governance.

DAO code is difficult to modify once it's deployed on the blockchain. Fixes require writing new code and migrating all funds, which is time-consuming and risky. This makes it harder for developers to fix known security flaws than with a centralized codebase.

In 2016, The DAO became the largest crowdfunding campaign to date; however, a flaw in its design allowed investors to withdraw money that had not yet been committed to a project at will. As a result, The DAO quickly ran out of funds due to numerous withdrawals by hackers exploiting known security flaws in its codebase.

Some observers are skeptical of DAOs, suspecting they are nothing more than new ways to speculate, or at worst, vast scams.

Recently, AnubisDAO members lost hundreds of thousands of dollars invested in the project before seeing the money raised mysteriously transferred out of the group.

Scam or not, DAOs remain risky investments because the project, like any young startup, may very well stop after only a few months or see its value drop drastically.

credit photo @unsplash